As has thankfully become a bit of a tradition again, post-COVID, ITSA (International Tax Stamp Association) recently held a pre-conference seminar on the occasion of the High Security Printing™ Latin America conference, which this year took place in Santiago, Chile.

With a focus on the importance of analysis and evaluation of needs prior to implementing a traceability system, attendees from the region were able to learn first-hand about experiences and results in Argentina, Chile, Colombia, Dominican Republic, and Ecuador, all of which have implemented tax stamp and traceability programmes.

Carolina Saravia from host country Chile’s tax authority, Servicio de Impuestos Internos (SII), gave a summary of the results of the country’s tax stamp and direct marking system on tobacco. She reminded the audience that taxes on tobacco have been found to be the most efficient strategy to reduce tobacco consumption and save lives, as well as save millions of dollars in public health costs.

Carolina Saravia.

In Chile, 63% of the price of a pack of cigarettes consists of tax, and as such, the incentive to avoid paying said tax is just too tempting. In 2018, the SII, after almost a decade of conducting analyses, and following an international public tender process, decided to entrust the development of a modern tax and production control system to SICPA.

Under this system (known as SITRAF – Sistema de Trazabilidad Fiscal), colourful, physical tax stamps are placed on imported cigarettes, while in-country cigarette production is marked directly on the assembly line using a 2D barcode with a unique ID and printed with secure ink. The production volumes from each line are then counted and transmitted, in near-real time, directly to the SII.

Post-production verification is managed by field inspectors using handheld devices, as well as by consumers, who can validate the stamps with their smartphones, using an SII app. Ms Saravia reported that verification rates had been very high. The system yielded generally positive results for the SII, and in 2023, it awarded a contract to SICPA for another five years.

Francisco Mandiola of FMA SECURE then reviewed the latest developments in Argentina and Colombia.

In the case of Colombia, the use of tax stamps has had a long history, but not for tobacco. Colombia uses tax stamps on different types of alcohol, with each region issuing its own stamp. This makes the cross-state visual fiscalisation process more difficult, although each stamp does carry a unique identifier and QR code that can be authenticated via a dedicated website.

Although taxation on cigarettes is not traced, the government’s plans (or rather threats) to implement traceability have been plentiful in the past decade or so. Colombia is a country to watch, given that the current government intends to implement an aggressive tax reform in 2025 to increase revenues and improve public health. This includes higher taxes on sugary drinks.

Argentina recently launched an international public tender to update its tax stamp programme and make it traceable. STIC, its new name, was implemented in mid-2023, prior to the change in government. It is similar to Chile’s physical stamp programme in that the stamps are controlled automatically on the production line and carry security inks and traceable unique identifiers.

The adoption of the new programme came in the wake of a startling discovery by Argentina’s tax authority – Administracion Federal de Ingresos Publicos (AFIP) – that as much as 91% of existing tax stamps were vulnerable to adulteration. Argentina therefore needed to act quickly to rectify this disturbing situation.

Since then, however – and because Argentina never fails to entertain – tobacco producer Sarandi, which boasts a 40% share of the cigarette market, has appealed the new tax stamp system, claiming the new minimum tax, which this system will help to control, would be unconstitutional and anti-competitive.

AFIP will no doubt fight tooth and nail to make Sarandi and others comply with the system, especially since it estimates that over $500 million in additional yearly revenues will be forthcoming should the system function as planned.

Jorge Miñoso, a consultant for the InterAmerican Center of Tax Administrations (CIAT) and former Director of the TRAFICO fiscal traceability project at the Dominican Republic tax authority (Direccion General de Impuestos Internos – DGII), gave an interesting overview of the benefits of implementing a tax stamp and traceability system for governments in the region. He used Dominican Republic’s experience with TRAFICO (Sistema de Control y Trazabilidad Fiscal) to highlight certain issues and how they were addressed.

Jorge Miñoso.

In Mr Miñoso’s view, selective taxation on consumer goods is the dream of any selfrespecting tax authority. It allows for better control on products that are either harmful to health or the environment, or both, and at the same time generates additional traceable income for governments.

In the case of TRAFICO, the results were evident. In its first year of implementation (2019), the total amount of tax revenue on alcoholic beverages exceeded the accumulated revenue on the same product for the previous 10 years! More importantly, deaths by alcohol poisoning went from more than 400 yearly in 2020-2021 to zero deaths today.

Mr Miñoso’s presentation, in line with the seminar’s theme of analysis, stressed the importance of following international standards for developing, implementing, and operating tax stamp and traceability systems.

The final regional presentation was made by Veronica Villavicencio from SRI (Servicio de Rentas Internas), in Ecuador.

.jpg)

Veronica Villavicencio.

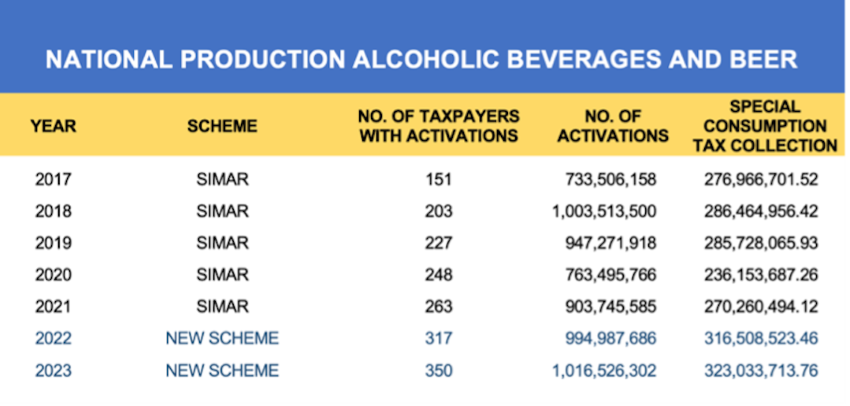

Ecuador has had a varied experience with traceability systems. From 2017-2022, it was using the SIMAR programme (System for Identification, Marking, Authentication, Tracking and Tracing), for controlling locally produced alcoholic beverages, industrial and craft beer, and cigarettes, for domestic consumption.

Although SRI was happy with the results of the programme, when the time came to renew the contract, it decided it wanted to try controlling each producer directly, using its own teams, as a test to see whether a public-private cooperation arrangement would work.

As a result, SIMAR was replaced with a more informational system where tax stamps are contracted by each taxpayer rather than by the government.

Today, all reporting activities are conducted between SRI and cigarette/alcohol producers directly, rather than through an external third party (as was the case with SIMAR). In addition, each producer is free to contract directly with its own tax stamp and traceability provider, as long as that provider complies with SRI requirements.

Ms Villavicencio was happy to report that revenues had increased significantly for alcoholic beverages under the new system, as shown in the table above – although some of this increase can be attributed to a new tax on imported liquor. The new tax is a reciprocity measure for a European tax applied on Ecuadorian liquor.

With Respect to Cigarettes, no Figures were Presented

In conclusion, she stressed how important a good legal base is for any future implementation, as well as robust technical and operational analyses, in order to evaluate the benefits of continuing, or not, with an existing traceability system.

Following the presentations by national authorities, a number of ITSA members spoke on the subject of implementing programmes on products other than tobacco and alcohol.

Specifically, Spencer Mandy of Canadian Bank Note Company gave a fascinating talk on how to prepare the path to legalised cannabis traceability, and Tim Driscoll of Authentix gave a lively update on fuel marking and its traceability.

This was followed by Stefaan D’Hoore of Luminescence Sun Chemical Security, describing how to combine a tax excise system with circular economy requirements, through deposit return schemes. Claudio Pino of SICPA then presented FCTC Protocol implementation guidelines for revenue authorities already running tax stamp programmes.

This is what some of the attendees had to say about the seminar:

Veronica Villavicencio, SRI, Ecuador, found it very useful because it allowed her to identify more products on which tax stamps can be implemented. She was particularly interested in ‘chemical tax stamps’, ie. fuel marking, and wanted to learn more about different suppliers of traceability systems.

Bernardo Pardo Perez, SERNAPESCA (National Fisheries Service), Chile, said: ‘we found the seminar very interesting because we were able to see other experiences of inspection bodies and also learn about new developments on the subject. I think it would be important to learn about other experiences in the fisheries and aquaculture sector’.

Jorge Miñoso, former DGII TRAFICO project director, Dominican Republic: ‘I found the seminar useful, as up-to-date topics related to tracking and tracing technologies, mainly for tax purposes, were discussed and addressed. In addition, different solution providers presented their innovations and products under development, which gives us an insight into new market trends. Moreover, the inclusion of presentations by government entities helps to understand the effectiveness of the solutions and their results after implementation.

‘I would recommend taking advantage of this forum to allow solution providers to perform live demonstrations and show some of the functionalities of their products in a more tangible and direct way. It would be interesting, depending on time and agenda constraints, to develop a roundtable discussion on a current issue in traceability, where experts (from suppliers, governments, and agencies) could present their points of view. This table could even be interactive, allowing questions from the audience.’

ITSA plans to hold a follow-up webinar in Spanish, around the beginning of October, for those authorities unable to make it to the in-person event.

In the meantime, the slides from the 10 presentations delivered at the seminar (some of which are in Spanish) can be downloaded from:

https://tax-stamps.org/all-resources/?c ategorie=%22Presentations%22