After several years of little to no travel as a result of COVID-19, it was wonderful to meet up with old and new colleagues again at the High Security Printing™ Latin America conference, held in Mexico City in March.

Similarly, this was the first time since 2019 (in Costa Rica) that the International Tax Stamp Association (ITSA) was able to hold an in-person workshop in the region.

ITSA workshops are regularly held in different regions throughout the year (although, lately, they have only been taking place in webinar format). The workshops are open to ITSA members and government authorities, and typically include case study presentations by tax authorities, technology updates by ITSA members and interactive discussions around a specific theme.

Although many governments in the Latin American region were still hesitant about allowing tax administration members to travel, there was nevertheless a good showing of government authorities at the Mexican event, including delegates from Argentina, Chile, Belize, Colombia, Costa Rica, Guatemala, Panama, the United States and, of course, Mexico.

The ITSA workshop began with a brief overview of the global growth of tobacco traceability systems to increase tax revenues and counter illicit trade.

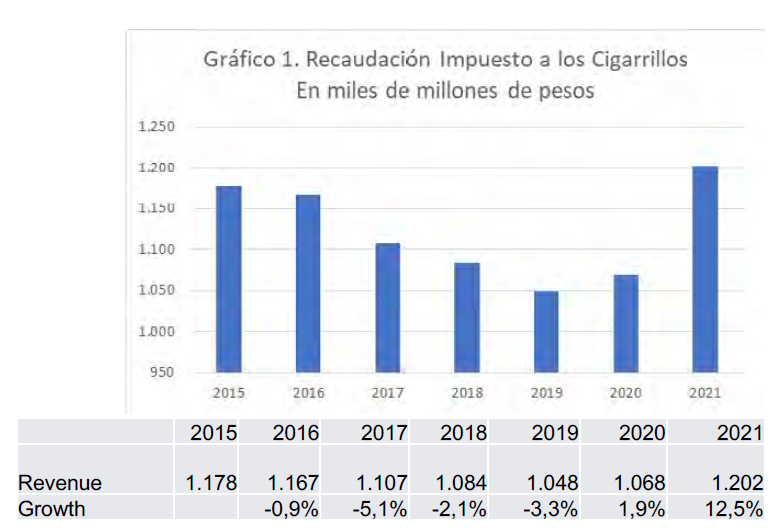

Then Michel Jorratt de Luis, former Head of the Chilean tax authority (Servicio de Impuestos Internos – SII), gave an update of the functionality and results of Chile’s tobacco tax stamp and traceability system. This included some interesting graphs showing the effectiveness of the system in increasing government tax revenues, without the concomitant need to raise tax rates.

Cigarette tax revenues in Chile, 2015-2021, in billions of Chilean pesos (source: SII).

Cigarette tax revenues in Chile, 2015-2021, in billions of Chilean pesos (source: SII).The first graph shows a series of descending revenues between 2015-2019, based on cigarette tax in billions of Chilean pesos, followed by a revenue upturn starting in 2020.

According to Mr Jorratt, this upturn was a direct result of the implementation, in 2019, of Chile’s SITRAF tax stamp and traceability system (SITRAF stands for Sistema de Trazabilidad Fiscal), which had a positive effect on tax evasion rates, as shown in the below graph:

Cigarette tax evasion rates in Chile, 2011-2021 (source: SII).

Cigarette tax evasion rates in Chile, 2011-2021 (source: SII). Mr Jorratt concluded that SII was very happy with this result, which for 2021 alone, had added another US$267 million to the nation’s coffers.

Francisco Mandiola of FMA Secure (who also chaired the workshop), then gave an overview of tax stamp and traceability initiatives in Latin America and the Caribbean.

He began by pointing out that the ability of many governments to come out of the COVID-19 pandemic on a positive footing could rely on measures such as carefully managed tax stamp systems.

Due to COVID, governments within the region suffered from a reduced workforce, huge budget deficits as a result of increased healthcare costs, a rise in informal economic activity in many sectors, and a surge in ‘creativity’ by illicit actors to make their activities more difficult to track with traditional tax enforcement systems.

Examples of tax stamp and traceability initiatives in Argentina, Brazil, Colombia, Costa Rica, Dominican Republic, Ecuador, Mexico and Venezuela were addressed, as were opportunities – or lack thereof – in Guatemala, Honduras, Nicaragua, El

Salvador, and Panama. (See TSTN July and August 2021, for a full description of Mr Mandiola’s two-part regional analysis.) Mr Mandiola stressed that Latin America, with its constantly evolving political landscape, is a market that solution providers should watch out for with regard to tax stamps and modern traceability and authentication systems – not only for controlling tax evasion on cigarettes, but also for countering illicit trade in alcohol, gasoline and cannabis.

Cédric Pruche, from SICPA, followed the pan-regional review with a deep dive into direct marking, digital tax control, and other forms of tax control available today for applications such as cannabis, fuel and VAT.

SICPA has several government references in the region, having implemented tax stamp, traceability and authentication systems in Ecuador, Dominican Republic, Brazil, the United States, Canada, and Chile. Mr Pruche went on to show a slide of concrete results at a global level, in terms of reduced tax evasion rates and increased revenues, as a result of tax stamp and traceability systems introduced in countries across the world.

Following that, the audience was regaled with a cannabis seed-to-sale certification system that allows licensees to register traceability information relating to the agricultural process, and also allows consumers to digitally verify the origin and quality of a given cannabis product, by authenticating a printed proprietary QR code on a counterfeit-resistant label.

Mr Pruche then went on to describe the typical ways in which fuel fraud can occur along the supply chain, showing a flow chart of activity and indicating where a marking and track and trace system can digitally pinpoint illegal practices.

VAT tracking is a new and very interesting system leveraging the just-in-time and extensive use of electronic invoice information and taxpayer history to characterise risk levels for transactions and detect fraud.

Based on a unique set of capabilities using AI and big data, SICPA proposes a turnkey service supporting the selection of cases of VAT non-compliance, and the execution and follow-up of different actions, through communication and on-site supervision platforms. The aim of the service is to enable substantial increases in VAT compliance and additional income for governments.

Finally, Mr Pruche presented CERTUS®, a digital authentication system based on a digital security seal, secured by tamper- proof blockchain technology that is used to protect, verify, and guarantee the integrity of data and credentials. This system has been applied to protecting the content of notarised documents, diplomas, and online health documents (such as vaccine travel documents and prescriptions), among others.

The workshop participants were then treated to a presentation by Gerben van Wijk, of Luminescence Sun Chemical Security, who challenged the audience to ‘see the unseen’, using innovative solutions and machine-readable features on tax stamps.

The solutions included:

UV fluorescence technology that can create any colour from an RGB (red, green, blue) combination.

Inkjet-printed covert barcodes, comprising a black infrared-transparent barcode printed over a clear infrared- absorbing barcode. With this dual layer solution, consumers can read the black code with a mobile device and authorities can scan the hidden barcode with a specialised device, as part of a track and trace system.

Infrared up-conversion, where the exposure of an invisible or coloured ink to an IR light source emits a visible dot on the print.

Taggants that only respond at a very specific wavelength.

As recommended by ITSA and ISO 22382, such a suite of technologies, with their multiple authentication levels, is key to assuring the security and recognition of a tax stamp, for both tax authorities and the public.

Michael Ritschewald from LEONHARD KURZ then took to the podium to talk about the company’s visible digital seal (VDS) solution for tax stamps.

As most of our readers are aware, KURZ is well-known for creating KINEGRAM foils for banknotes, as well as KINEGRAM solutions for government identification documents. A third area is the company’s TRUSTCONCEPT® solutions for tax stamps, which includes VDS.

Mr Ritschewald informed the audience that a VDS is a cryptographically signed data structure that is encoded into a two- dimensional barcode, which is usually a QR code. The code contains essential data pertaining to a respective document, as well as a digital signature used for ensuring the integrity of the data and authenticity of the issuer.

Using KURZ’ VDS app, together with any normal smartphone, the user is able to visually verify the authenticity of the QR code, ensure that the code has not been tampered with and authenticate the information contained therein, in a cost-effective manner, by means of asymmetric cryptography.

Currently, this technology is used to verify the authenticity of ID cards, COVID certificates, refugee registration permits and some visas. Mr Ritschewald informed the audience that VDS is, therefore, not a new technology, but has, rather, been in the market for over a decade, and could now also be applied to tax stamps.

In fact, in 2018, ITSA created a model tax stamp carrying an electronically encoded data set encoded into a data matrix code (in line with French technical standards), in order to demonstrate that VDS was a proven, cost-effective technology that was easy to verify, and that offered interoperability, secure coding, and standardised global technology.

This model tax stamp now forms part of a new international standard, (ISO/ DIS 22385 – currently in draft form) for establishing a trusted information processing and communication framework that uses interoperable object identification techniques to protect the integrity of physical and related electronic documents, with the aim of mitigating product fraud and counterfeiting.

To conclude the seminar, Mr Mandiola went through the results generated from a multi-choice questionnaire that had been completed earlier by attendees.

The questions related to best practices recommended by ISO 22382 (the ‘tax stamp standard’) and ITSA, and attendees were asked to select only one answer for each question, in order to ascertain what was most important to them with regard to each practice. For example, some of the questions, and possible answers, were:

What is the primary function of a tax stamp?

a. Revenue collection

b. Tracking, tracing, monitoring (control)

c. Consumer reassurance

d. Legislative compliance

What kind of suppliers should produce tax stamps?

a. Commercial printers

b. State-owned printers

c. Security printers

d. Other

Which of these must always be included in a tax stamp?

a. Security inks

b. Overt security features

c. Covert security features

d. Holograms

e. Unique identifiers (UID)

What is the main tool for examining/verifying a tax stamp?

a. Naked eye

b. Smartphone

c. Special reader

d. Tools to detect specific ink reactions

What defines what type of UID will be chosen by a tax authority?

a. Interoperability with traceability and database software

b. How it will be generated

c. Level of security required/desired

d. What format it will have: physically printed or digitally marked

e. Authentication/verification techniques

What do you consider most important when deciding between a physically printed and digitally marked stamp?

a. Packaging used

b. Type of public

c. Production speed

d. Environmental conditions/impact

e. Falsification of the stamp

What stakeholders must be part of the decision to implement a tax stamp strategy?

a. Tax authority

b. Legislative body of government (congress/parliament)

c. Consumers/public

d. NGOs

e. Producers of product to be taxed

The questionnaire resulted in a lively discussion which revealed that, while most participants agreed on the importance and potential benefits of a tax stamp system, not everyone had the same views on which type of elements were more suitable than others or what level of involvement by tax payers in their own regulation was appropriate.

It will be interesting to see what further discussions arise from ITSA’s next workshop, to be held on 16 May during the Tax Stamp & Traceability Forum™, in Malta, when this exercise will be repeated.