The global software engineering company ELEKS has been awarded a tender to develop Ukraine’s ‘e-Excise’ tax stamp and traceability programme for tobacco and alcohol products. The programme is scheduled to launch in 2026. While Ukraine already applies paper-based tax stamps on tobacco and alcohol, they are not used for traceability purposes.

eExcise is a collaborative effort between the Ministry of Digital Transformation, the Ministry of Finance, and the State Tax Service of Ukraine, with support from the Digital Transformation Activity (DTA). The DTA is a five-year, $150 million programme dedicated to enhancing Ukraine’s digital capabilities, and funded by the US Agency for International Development (USAID) and UK International Development (UK Dev).

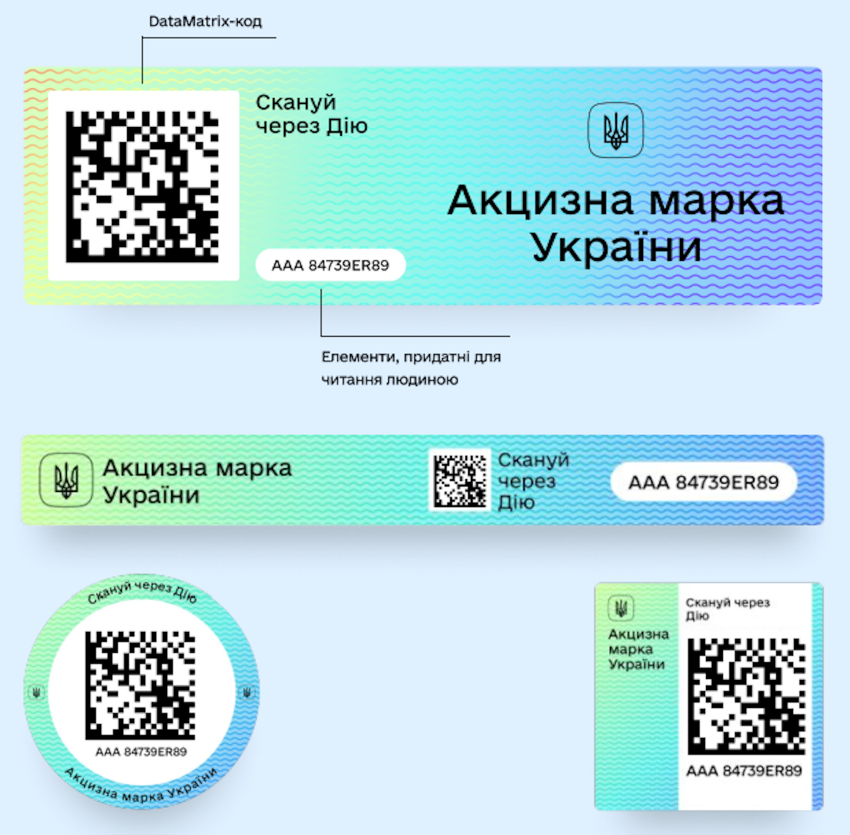

The eExcise system consists of a series of secure labels carrying serialised datamatrix codes, for application to individual packs, bottles cans etc., as well as to outer packaging for aggregation purposes.

The codes are generated by the solution that ELEKS builds and sends electronically to economic operators. The operators print the codes onto the blank labels, which they receive separately, and then apply the labels to the products. The codes are activated once the relevant tax has been paid and additional product details entered into the eExcise system. The labels allow the movement of alcohol, tobacco products and liquids for e-cigarettes to be tracked from the manufacturer/importer to the final consumer.

Consumers can also scan the labels using the e-governance Diia app. This allows them to access information on product description, manufacturer, place and date of production, current location of the product, and stamp status.

If the stamp bears the wrong information or is inactive, one click will be enough to notify the government via Diia.

‘Diia’, which in Ukrainian means ‘action’, is also an acronym for ‘meet the state’. Created in partnership with USAID, this mobile app and online portal currently connects about half the country’s population with more than 120 government services – including benefit schemes,

tax declaration services, and business registration and management services – as well as giving citizens access to numerous government documents.

Something of particular interest with Ukraine is that its eExcise system seems to be very much integrated into the country’s entire e-governance platform, which is not often the case elsewhere. Indeed, excise management systems are usually kept apart from broader tax systems due to the specialised nature of excise duties, higher evasion risks and compliance requirements, and complex operational conditions.

The eExcise family of labels (© ELEKS).