A little over two years ago, Costa Rica was in the throes of allegations by TRACIT (Transnational Alliance to Combat Illicit Trade, www.tracit.org) that the best way to fight illicit tobacco trade was through a close collaboration between private sector companies (eg. tobacco producers) and the public sector.

Despite an onslaught of well-funded promotions by political and commercial adversaries, Costa Rica’s Law 9961 was nevertheless passed in the nation’s congress in March 2021. This law was meant to curtail the adulteration, imitation and counterfeiting of alcoholic beverages as well as the smuggling of said beverages into Costa Rica.

The law further stated that the mechanism for this control (ie. a technologically modern traceability system) would be defined by the Ministry of Finance within 18 months of Law 9961 being signed, which was on 24 March 2021. This meant that the control mechanism should have been defined by September 2022. Instead of this happening, however, the Ministry of Finance coincidentally published a cost-benefit analysis with seemingly one purpose: to disprove the benefits of implementing a modern and efficient traceability system in Costa Rica.

The 20-page analysis appears to be a credible, albeit belated, effort by the Ministry of Finance to comply to Law 9961’s requirement for a cost-benefit analysis of the potential new traceability system prior to implementation.

The data contained in the analysis was compiled from sources within the Costa Rican General Customs Directorate as well as from ‘national and international corporations offering traceability systems’.

The document bases its conclusions on what the Ministry of Finance considers to be the elevated costs of implementation and logistics required to comply with Law 9961, as well as the purportedly negative experience that many countries have had with implementing modern traceability systems.

In short, the study concludes that while it is true that some countries initially show favourable results from implementing such systems, in the medium term, the systems generate very high costs for the industry and tend to have a negative effect on the consumption of legal alcohol.

Additionally, the systems do not show consistent improvements over time in terms of collection, which is why, according to the study, countries that have implemented this type of scheme in the past are now in the process of eliminating them.

The costs used in the study were provided by ‘several private companies’ and estimated to be between $0.10-0.14 per tax stamp, including logistics costs. This would appear to be an assumption based on limited research as, according to the International Tax Stamp Association (ITSA), most tax stamp costs are usually under $0.05 per stamp.

In particular, for the case of Costa Rica, the logistics costs for the importer/distributor to apply a tax stamp already exist and should not be replicated, given that an existing Costa Rican law already requires an application of specific labels on each product prior to release into the local market.

Another point is that in countries where tax stamps are applied and successful, many of these countries follow the recommendations of the WHO Protocol to Eliminate Illicit Trade on Tobacco Products, which clearly states that ‘each party may require the tobacco industry to bear any costs associated with that party’s obligations under this Article’.

The logical step would therefore be for Costa Rica’s government (which is party to the Protocol and therefore obliged to implement track and trace on tobacco products by September 2023) to transfer the same recommendations to the alcoholic beverage industry, instead of unnecessarily shouldering the cost of the system using public finances, as the study would suggest.

The implementation costs in the study also fail to take into consideration documented experience from countries around the world that are seeing the implementation of a tax stamp and traceability system, not only as a solution to tax evasion, but also, as a means to reduce public expense in health costs.

These vary between products and countries, but in late 2022, the World Bank published the benefits of what it calls ‘health taxes’, which are excise taxes imposed specifically on products (tobacco, alcohol, sugars) that negatively impact public health.

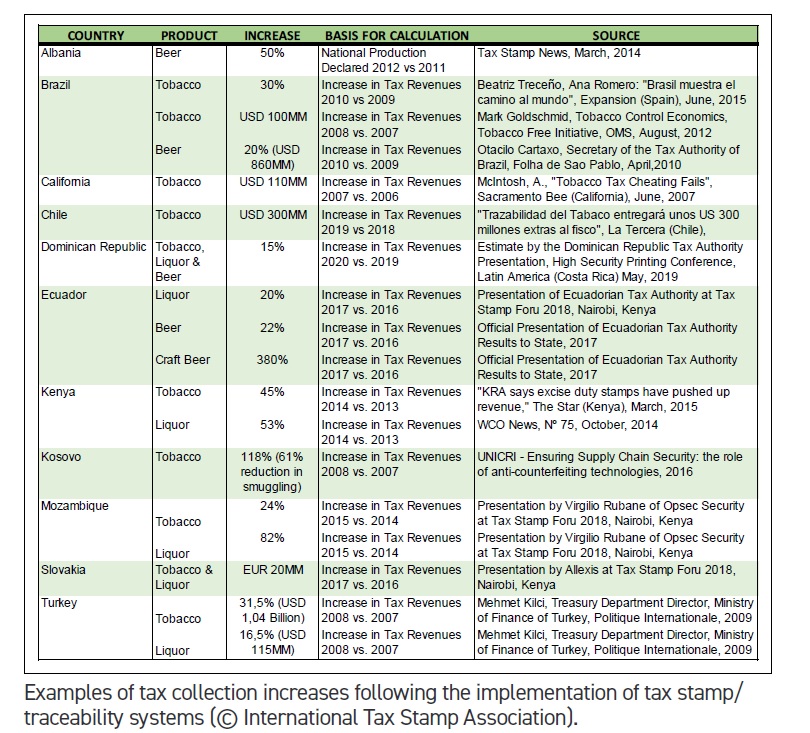

Both the World Bank and International Monetary Fund have noted that in most cases, the increase in tax collection from implementing an efficient tax traceabiility system ranges from 20-50%, usually more than enough to offset any implementation costs.

Furthermore, the below table, provided by ITSA, belies the supposed trend of countries eliminating or becoming disenchanted with tax stamp traceability systems and perhaps serves to better explain why there are over 120 billion tax stamps printed every year, helping to control cigarettes and liquor in over 90 countries.

One would hope that the Ministry of Finance of Costa Rica will continue with the implementation of Law 9961 (to date, no mechanisms have been defined) and take into consideration that, according to ITSA, with just a 20% increase in tax collection the cost-benefit ratio would be 1 to 7.5, based on more realistic tax stamp system costs. And if increases are greater, the odds only improve.

For those interested in reading the report, the complete study is available at www.hacienda.go.cr/docs/EstudioTrazabilidadLicoresLey9961.pdf.