In 2011, Chile began seriously considering implementing a tax stamp and traceability programme, when Michel Jorratt, a member of the Chilean tax authority, Servicio de Impuestos Internos (SII), published a study estimating that over $500 million were being evaded yearly in cigarette tax in Chile.

Despite subsequent efforts by different providers, the SII did not act in haste when implementing the programme. Laws had to be changed and passed in congress, and ministries and tax officials had to be educated and feel sufficiently informed and confident in their decisions, in order to promote such a change.

In the same way that we tax stamp strategy consultants cannot stop stressing the importance of adequately written laws and regulations, and well-managed and transparent tender procedures to provide a fair playing field for traceability providers, the SII took every step carefully and judiciously.

This led to the implementation of the SITRAF tax stamp and traceability program (SITRAF stands for Sistema de Trazabilidad Fiscal). The program was provided by SICPA as the final result of a lengthy and well-oiled tender process. SITRAF was designed to mark individual cigarette packs directly for national production and put physical tax stamps on imports.

Despite being adjudicated in 2017, the traceability of cigarettes in Chile was finally implemented in March 2019. At that time, existing cigarette providers were given a three-month grace period to sell off all inventories of unmarked products, at the end of which the SITRAF system began working in earnest within the country.

Recently, the Finance Ministry of Chile published results of many of its projects. Despite the fact that the COVID-19 pandemic has limited the controls normally carried out by the SII and National Customs Service – including new controls associated with the traceability system – the tax collection figures for 2020 and the first half of 2021, show a more than positive effect on the recovery of specific taxes on cigarettes.

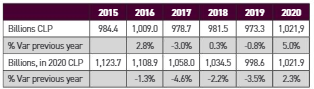

While overall tax collection in 2020 went down 6.6% in nominal terms compared to the previous year, specific tax collections on cigarettes were 5% higher. If measured in terms of 2020 prices, the increase is 2.3% (see Table 1).

Also of note is that specific tax on cigarettes, measured in 2020 prices, had been falling year after year since 2015. There are two reasons posited for this: a decrease in consumption as a result of government health initiatives and, more importantly for this writer, an increase in tax evasion. As of 2020, this trend was reversed, coinciding with the implementation of SITRAF nationwide.

It is important to note that if the previous years’ downward trend had continued, tax collection for 2020 would have gone down by about 3.4% instead of increasing by 2.3%. The reversal in this trend is responsible for an increase in tax collections equivalent to about $82 million, all due to the correctly functioning traceability system. Moreover, if one is to be precise, another $23 million was recovered from lower VAT evasion.

Finally, this lower amount of evaded tax also leads to an important assumption: that cigarette sellers had a 30% profit margin over revenues, again assuring another $10 million in taxes to be reaped by the SII.

In total, over $115 million is estimated to have been the year’s gains from reducing the evasion of taxes on cigarettes sold, a figure well over the estimated $6 million annual cost of running the entire SITRAF system.

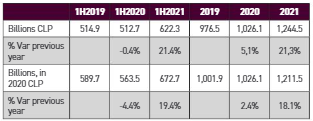

It is difficult to not be happy with the figures for the first half of 2021. As shown in Table 2, not only has the collection of tax on cigarettes increased significantly in nominal terms, growing 21.4% in comparison to the first half of 2020, but the increase in real terms against the Chilean peso was 19.4%.

Another promising fact is that the specific tax collection for the first half of 2020 fell 0.4% in nominal terms (4.4% in real terms), compared to the same period in 2019. This correctly presumes that the growth in annual collections for 2020 occurred during the second half of the year, coinciding with the implementation of the SITRAF system.

It is estimated that if this trend continues for the remainder of 2021, the result will be a nominal increase in collections of 21.3%, or 18.1% in real terms.

If we repeat the same total tax revenue analysis previously done for 2020, we can conclude that the end of 2021 should be a very positive one for the SII.

The projections would show that should tax collections continue along the previous years’ trend, the collection for the first semester of 2021 should have fallen by 3.4% for the first semester of 2021, instead of increasing by 19.4% in real terms. This difference translates into a higher collection equivalent of $196 million, again attributable to the traceability system.

To this higher collection amount, one must add another $55 million due to lower VAT evasion, which translates into a higher profit to be taxed. Again, assuming that the seller’s profit margin is 30% on revenue, this would result in a higher collection of $23 million.

Finally, one could estimate that there would be a higher total tax collection amount for the first half of 2021 of about $274 million. Should this trend continue in the second half of 2021, then Chile’s reduction of tax evasion from cigarette sales would be almost at the amount projected by Mr Jorratt in 2011.

No mean feat for a system that will cost the Chilean state less than $3 million per semester.

Source: Ministry of Finance, Chile.

Source: Ministry of Finance, Chile.